2025 marks a definitive turning point in German real estate, with a transition from “wait-and-see” to growth driven by inflation stabilizing around 2.1%. On a macro level, the German residential market demonstrated resilience with an average annual rent increase of 4.1% and condominium prices rising by approximately 2.5%. On a micro level, Berlin is leading the national recovery among German cities with a 31% surge in investment transactions and the strategic return of institutional players. The structural housing shortage in the capital is pushing demand toward “Second Ring” districts, such as Lichtenberg and Treptow-Köpenick. This combination positions 2026 as a strategic window of opportunity for investments focused on data-driven strategies, disciplined cash-flow management, and ESG compliance.

Those following the German market over the last two years likely felt the evident tension within the industry. On one hand, headlines regarding price corrections and a challenging interest rate environment kept many investors on the sidelines. On the other hand, the reality on the ground told a different story: high tenant pressure for every available unit, following double-digit increases in 2024, Residential rents in Germany continued to climb throughout 2025.

In 2025, this dissonance began to fade. Uncertainty was replaced by market stabilization, and hesitation gave way to action. In this annual review, we analyze the macroeconomic forces, demographic shifts, and the new opportunities emerging for 2026. It is important to note that the current environment is particularly suited for investors with a medium-to-long-term horizon who prioritize cash-flow stability, controlled leverage, and a phased market entry.

Macroeconomics: Stability is the Real News

While the German economy did not experience a sharp rebound in 2025, it appears to have found its floor. Following the market turbulence of 2023–2024, inflation has converged toward a target of 2.1%-2.2%. Crucially, financing rates for real estate have stabilized at levels that allow for business certainty and long-term planning. The broader German macro environment signals clear stabilization: forecasts from leading institutes (ifo, DIW, ifW, and SVR) project 0.1%-0.2% growth for 2025, accelerating to 0.8%-1.3% in 2026.

For the seasoned investor, the critical metric is not just the rate itself, but certainty. The ability to price deals with high precision has restored confidence to the banking system. With a stable unemployment rate of approximately 6.3% and growth projected to accelerate in 2026, Germany’s economic engines are returning to controlled activity. a classic profile of a market that has undergone a healthy correction and emerged from its deterioration phase. Residential price indices already indicate stabilization and even a moderate 2%-3% increase during 2025 – an early sign that the market is building the foundation for a new growth cycle.

National Outlook: The German Residential Market Continues to Strengthen

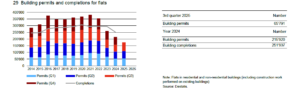

Beyond Berlin, a similar trend was recorded at the federal level in 2025. National rental indices from FPRE, bulwiengesa, and vdp indicate an annual rental increase of approximately 4.1%. Simultaneously, sales prices have stabilized, with residential apartments (CON) seeing a moderate rise of 2.5% and single-family homes (EFH) increasing by about 2.1%. The nationwide decline in new construction starts, coupled with positive net migration, continues to exert structural pressure on the rental market – a trend set to persist into 2026.

The New Berlin Geography: Moving to the Second Ring

A defining trend of 2025 is the shifting geography of urban investment. While historic central districts (Mitte, Prenzlauer Berg, Friedrichshain) continue to see high demand, they suffer from chronic supply shortages and price points that yield relatively lower returns.

Consequently, there is a growing movement of investors toward the city’s “B-Zone” (Second Ring). Reports from Berlin Hyp and CBRE indicate that in 2025, development hubs shifted to districts like Lichtenberg and Treptow-Köpenick, as well as parts of Wedding and Neukölln.

This trend is reinforced by a persistent decline in new construction starts, creating a structural supply-demand gap that pushes both tenants and investors outward. In this context, what is happening in Berlin reflects a broader process occurring in other major German cities, where demand spills from expensive centers to neighborhoods with high accessibility and attractive pricing.

These areas offer an attractive mix for 2026:

- Accessibility: Excellent connectivity via the extensive S-Bahn and U-Bahn networks.

- Pricing: Entry prices per square meter that still allow room for appreciation and future gains.

- Demand: Internal migration of high-quality tenants seeking modern, affordable housing.

The Return of Institutional Capital

The clearest signal that German real estate prices have bottomed out and are beginning to rise is the return of Institutional Investors and Family Offices. These entities operate based on cold, professional data analysis free from emotional influences.

CBRE reports a 31% increase in transaction volume in Berlin over the first three quarters of 2025. BNP Paribas reported nearly €1 billion flowing into Berlin’s income-producing real estate in Q1 alone, while Savills noted a 14% rise in residential transaction volumes across Germany. When the market’s most conservative players return to purchasing entire portfolios, they are effectively “validating” current price levels. This represents a rare window for private investors to acquire assets alongside institutional giants before increased competition drives prices back up.

ESG: The Quiet Revolution

If ESG was once viewed as a theoretical concept, in 2025 it became a core component of every real estate due diligence process. The German economy is in the midst of a profound transition toward energy efficiency, and federal environmental regulation (GEG) has become a decisive parameter in investment decisions.

At Inspiration Group, we view ESG as a strategic tool for value creation:

- Financing: German banks now offer “Green Loans” with preferential interest rates for assets with high energy ratings.

- Market Value: A widening price gap is emerging between outdated structures and energy-efficient, renovated buildings.

- Operations: Energy-optimized assets attract higher-quality tenants and reduce long-term maintenance costs.

In every project, we evaluate energy upgrade potential as an integral part of the exit strategy. By 2026, assets that do not meet these standards will simply be harder to divest.

Outlook for 2026: Inspiration Group’s Roadmap

The demand reflected in the data is translating into significant activity on the ground. Inspiration Group has operated continuously in the German market for over 15 years, maintaining stability through various market cycles.

As we look toward 2026, our activity map reflects strong investor confidence:

- Three active projects in Germany are currently in the fundraising and establishment stages.

- Two projects have already been fully funded, a testament to the returning demand from investors recognizing the market’s turning point.

2025 was the year of stabilization; 2026 is expected to be the year of deepening market activity. While the window of opportunity created by the price correction remains open, the return of institutional capital and continued rental pressure suggest that today’s price levels represent an opportunity that may be difficult to replicate in the foreseeable future.

Data Sources: The information and graphs in this review combine Inspiration Group’s professional experience with data from the Meta-analysis Real Estate Germany (Dec 19, 2025) by Fahrländer Partner (FPRE) , aggregating data from the ifo Institute , bulwiengesa , vdpResearch , Destatis , and the German Central Bank.